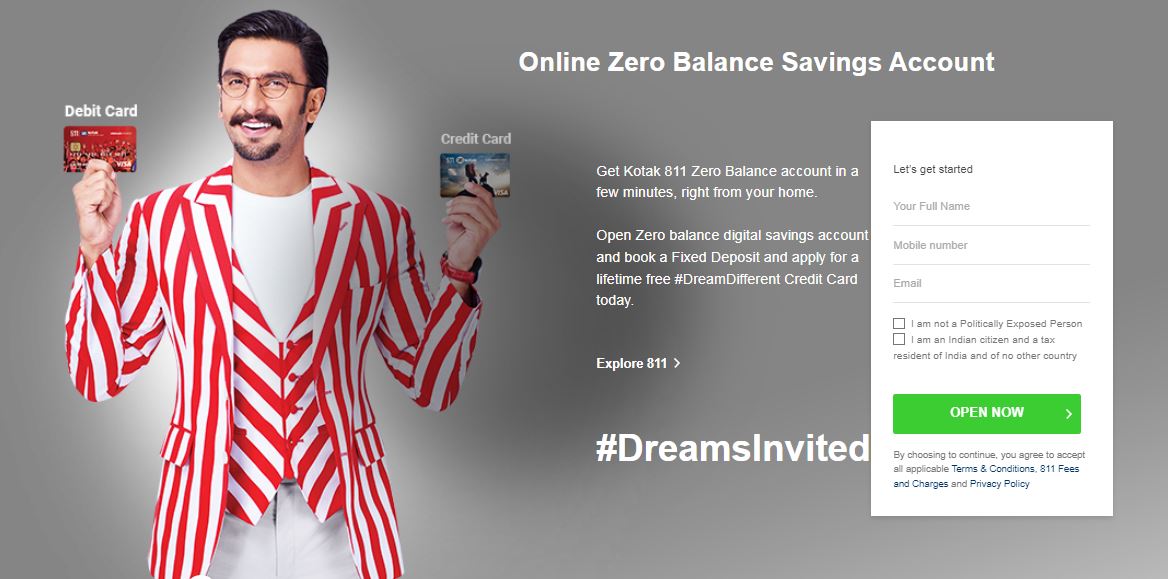

Kotak credit card, You can do apply at home online or by going to their Kotak 811 credit card office & you can best Kotak Credit Card apply without showing Income and CIBIL score and make it free for life.

Nowadays everyone wants to make a credit card because it has many advantages which are not with the debit card. Like if you pay today,

then it has to be paid after 50 days through your credit card, there are many more benefits and also offers that are possible through credit cards like online shopping, mobile tickets, and many more.

How to Start Kotak credit card

You have to fix the deposit of 10 thousand rupees in this account for the first 6 months.

and 80% of it you will get credit limit which is very good, you can also apply online or go to their office. So with the help of this process, you can apply for Kotak Credit Card.

#Related Question

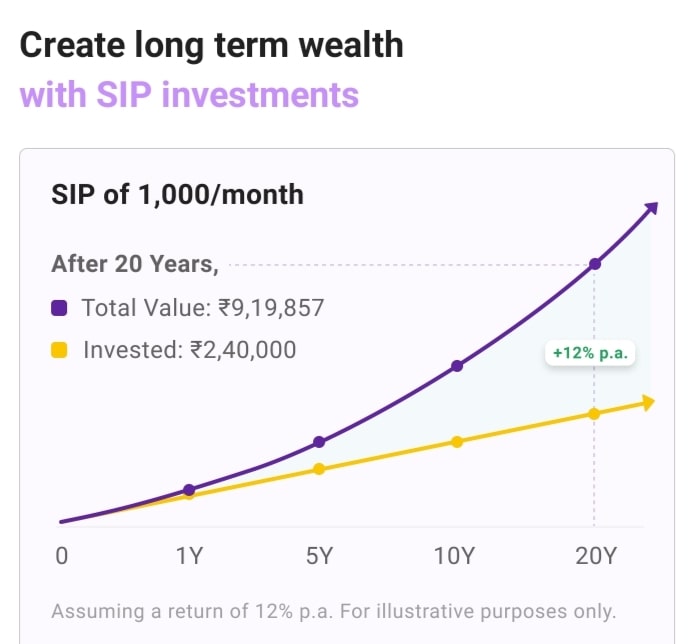

How SIP works and the Top 5 Benefits of SIP, we will know about them What is SIP and then how SIP Works…

Read More

Benefits of Kotak credit card | Adnavtages

① First of all, its benefits are that to take it, you do not have to show any civil score nor do you have to provide any income proof, which is why Kotak Mahindra bank credit card gives one benefit to the credit card as compared to other credit cards.

②The good thing about it is that there is no joining fee and no annual charge and it is a lifetime free charges credit card.

③ In this credit card, you get to see Kotak 811 #DreamDifferent Credit Card, the benefit of which is that if your Kotak credit card is stolen or if there is a fraud transaction, then you report it for 7 days after the fraud transaction, then you will get here 50 thousand covers is given which makes best Kotak Credit Card a better and better one

④ There are also benefits with their rewards that if you do online shopping or spend 100 rupees with this best Kotak credit card, then you are given 2 reward points and if you spend offline with Kotak credit card then you will be given 1 reward point.

They have many more benefits which you can know by visiting their official site.

Kotak credit card eligibility

Advantages, Features and Kotak credit card eligibility

- If your age is 18 or more then you have to make some fixed deposit to Kotak credit card

- Everyone can take this credit according to their best kotak credit card eligibility

- On the basis of this Kotak credit card, you can also take an add-on card for your family member

- Only Individual TDs are allowed for this credit card

- The criteria for this Kotak credit card eligibility are very simple.

Kotak credit card charges | Disadvantages

If your fixed deposit is 10 thousand, then you will be given a limit of 80 percent of it. Like if you want to take a phone and its price is 15000 thousand then you can not take it because according to your fixed deposit you can credit only 8000

That’s why you have to do more fixed deposits than you can use well.

Disadvantage of Kotak credit card charges

It has a fixed deposit interest rate which is very low 4.5% as compare to other fixed deposit bank

Kotak credit card apply

Before applying this, you must have a Kotak Mahindra mobile app account, which you can also download from the play store.

After signing up you will see the button of applying now in the dashboard of the Kotak Mahindra App

I am going to tell you it’s stepwise first.

Step ①

- Click Apply now option

- Click Credit Card option

And you will come across something else written with your name

Step ②

Get an instantly approved credit card against a fixed deposit

- Click terms & condition

- Click Get it now Button

- More Features Continue

- Get your Credit card your delivery address Complete 3 Simple Steps

- Card Delivery Address

- Choose Your Credit Card Limit

- Set Up Fixed Deposit

After submitting the address, after confirming you, after setting the limit, then after making your fixed deposit,

Open New Fixed Deposit Click And You Have To Deposit Your Fund Then You Will Be Able To Use best Kotak Credit Card

Fund Your Account

Transfer Funds via NEFT/IMPS

Get transfer details at a glance and deposit for you best kotak credit card eleigibility

So, with the help of this process, you can Kotak Credit Card apply with the help of the Kotak Mahindra Bank Credit Card Mobile App.

Kotak credit card ifsc code

How to get your Kotak credit card IFSC code as it is very important for other transactions, so let us know how to get Kotak credit card IFSC code find online by Kotak Mahindra bank credit card app.

First, your Kotak credit card status check-in your Kotak Mahindra Bank Credit Card App

Before, Kotak credit card status check you can take all the details through their net banking so open the dashboard of your app and Click account overview

- Account Overview option, With the help of this you can get your best Kotak Credit Card IFSC Code

- Kotak 811 Credit Card option in Bank Menu so click, and then see your kotak credit card IFSC code

So with the help of these two options, you can remove your Kotak Mahindra credit card IFSC code

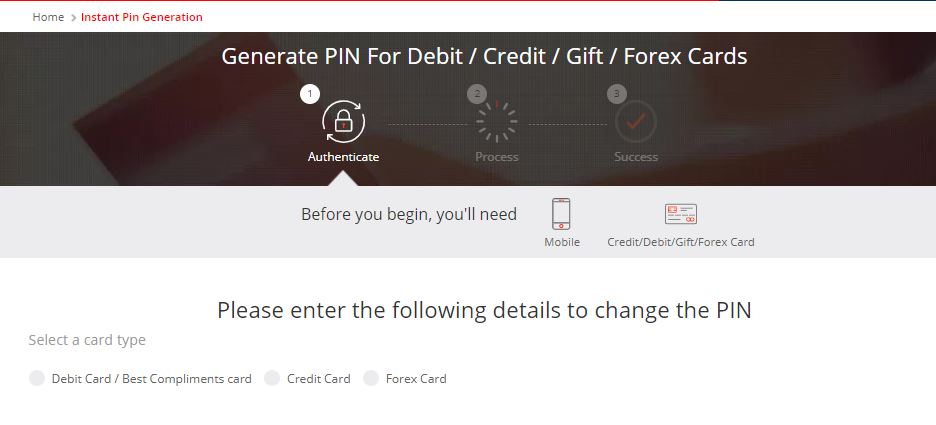

kotak credit card pin generation

For Kotak Credit Card PIN generation, first, you need to have Kotak Mahindra Bank Credit Card Mobile App, then you can Kotak Credit Card PIN generate at your home.

How to generate kotak credit card pin generation

- Open kotak 811 mahindra bank app

- Go to the credit card option

- and go to kotak credit card service request then click

There are many options in these service requests but you choose this option

- Click Instantly Generate Pin

So you can log in by your own biometric or 6 digits MPIN, logging, After that enter your Kotak credit card status like Expiry Date, CVV & New PIN, Confirm Pin, and then after you submit your Confirm Request.

And you can see Your request has been submitted successfully! A new PIN for your credit has been generated successfully

So, this is how to generate Kotak credit card pin generation with the help of Kotak Digital Bank

FAQ [frequiently Asked Question]

How can I activate my Kotak credit card online?

You have to fix the deposit of 10 thousand rupees in this account for the first 6 months. And 80 percent of it you will get credit limit which is very good, you can also apply online or go to their office. So with the help of this process, you can apply for Kotak Credit Card.

How can I generate my Kotak credit card PIN?

For Kotak Credit Card PIN generation, first, you need to have Kotak Mahindra Bank Credit Card Mobile App, then you can Kotak Credit Card PIN generate at your home.

How to generate Kotak credit card pin generation

Open kotak 811 mahindra bank app

Go to the credit card option

and go to best Kotak credit card service request then click

There are many options in these service requests but you choose this option

How do I find the IFSC code on my Kotak credit card?

First, your Kotak credit card status check-in your Kotak Mahindra Bank Credit Card App

Before, Kotak credit card status check you can take all the details through their net banking so open the dashboard of your app and Click account overview

Account Overview option, With the help of this you can get your Kotak Credit Card IFSC Code

Kotak 811 Credit Card option in Bank Menu so click, and then see your Kotak credit card IFSC code

So with the help of these two options, you can remove your Kotak Mahindra credit card IFSC code

What is credit card and its benefits?

① First of all, its benefits are that to take it, you do not have to show any civil score nor do you have to provide any income proof, which is why Kotak Mahindra bank credit card gives one benefit to the credit card as compared to other credit cards.

②The good thing about it is that there is no joining fee and no annual charge and it is a lifetime free charges credit card.

How does Kotak credit card apply?

Step ①

Click Apply now option

Click Credit Card option

And you will come across something else written with your name

Step ②

Get an instantly approved credit card against a fixed deposit

Click terms & condition

Click Get it now Button

More Features Continue

Get your Credit card your delivery address Complete 3 Simple Steps

Related Terms

- Understand How SIP Works | Top 5 Benefits of SIP

- Explain the Nature and Scope of Financial Management

- The Most Important Features of Management | 7 Characteristics of Management

- Most Importance of management Control | Management activities

- [Best] 10 Ways Improves the flow of business ideas With Low Investment

Summary & Conclusion

Now you must have understood that how to apply for a Kotak credit card, its benefits, advantages, disadvantages, and many other things like how to generate its PIN, then you must have liked to read this. so check Related terms

Like this information Or have something to Share!

Connect with us on Facebook