Chose flexible predetermined amount and interval Auto-debited from your bank account & Invest in a specific mutual fund scheme allocated a certain number of units benefits certain-Cost Averaging and Power of Compounding Benefits.

What is SIP ?

Before Knowing SIP, we know its full form of SIP

SIP : Systematic Investment Plan

This is the way through which you can invest your money in mutual funds. Easy, Flexible, and Smart Way for investing in the mutual fund.

① In Depth Definition Of SIP

You can invest in regular Mutual Funds through SIP Investment Mode. Where you will have the option to invest a predetermined amount at regular intervals and this predetermined amount can also be 500rs or it can be 1,000rs, 10,000rs, lakh anything.

And you can invest this predetermined amount on regular intervals on a weekly basis, monthly basis, on a quarterly or yearly basis also.

And here how much to invest, when to invest is already told predetermined, due to which what is SIP becomes a planned approach for investing.

And because of this planning approach, you automatically develop the habit of saving.

And by investing smartly, you also build wealth for the future.

So let’s now try to understand how a Systematic Investment Plan (SIP) works.

How SIP Works

- Chose flexible pre-determined amount and interval

- Auto-debited from your bank account

- Investment in a specific mutual fund scheme

- Allocated a certain number of units

- Benefits certain-Cost Averaging and Power of Compounding

- Benefits of Rupee-Cost Averaging and Power of Compounding

You must be wondering what is Rupee Cost Averaging and Power of Compounding.

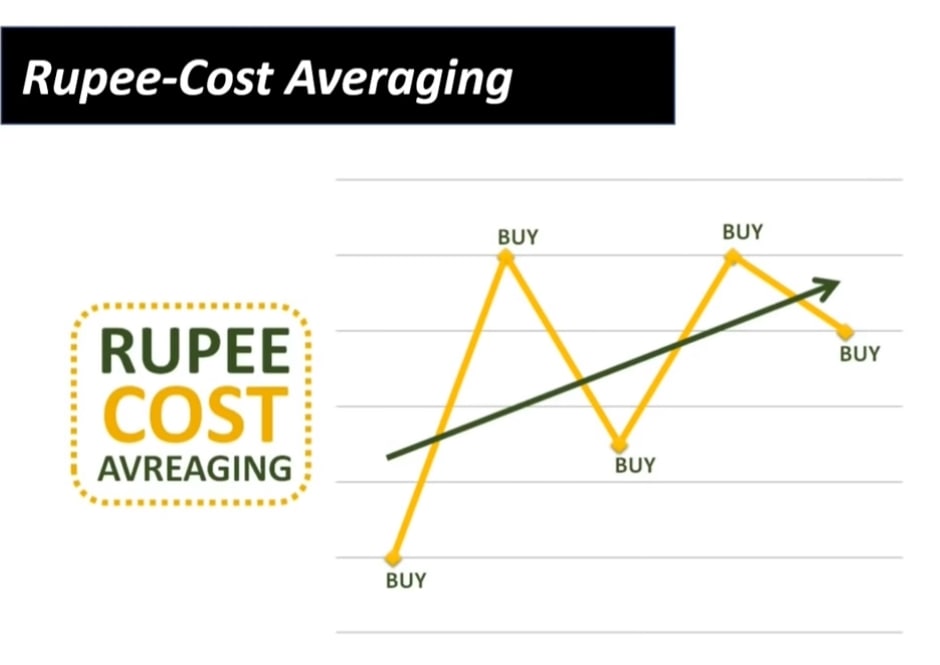

How SIP Works Rupee-Cost Averaging

Suppose you have a SIP investment of Rs 10,000, you decide to invest in stock instead of a mutual fund and the price of that stock is Rs 1,000. So if you do SIP investment this month, then instead of your SIP investment of 10,000,

You will get 10 shares of that company, and suppose when you go to do SIP investment next month,

and that time The price of that stock at that time will be Rs 2,000, Then in return for your SIP investment, you will get 5 shares of that company.

And next month when you go to invest, if the share price falls below Rs 2,000 to Rs 500, then you will get 20 shares of that company instead of 10,000 SIP investment.

And here you are noticing a common pattern, then your investment is fixed every month and here your investment is fixed every month when the market goes down, then automatically your purchase becomes more,

when where you get more shares and whenever the market is up then your buying is reduced automatically and you then buy fewer shares,

and So what will be the advantage,

Advantages of Rupee-Cost Averaging

The advantage whether the market goes up or falls down, your average buying price which is that balance Will continue to happen.

That means, whenever you invest in mutual funds through SIP, you will get the benefit of rupee cost averaging, so that whether the market goes up or down, you can be sure to invest your money.

and this is what we call Rupee-Cost Averaging in technical terms.

How SIP Works Power of Compounding

Let me tell you a story to explain the power of compounding,

That’s why I want to give you two examples so that you can differentiate between these two-man Suresh & Ramesh, how and how much they are increasing the value of their investment.

Example ①

There was a man named Suresh. And he joined a job and after joining the job, when he turned 35 years old.

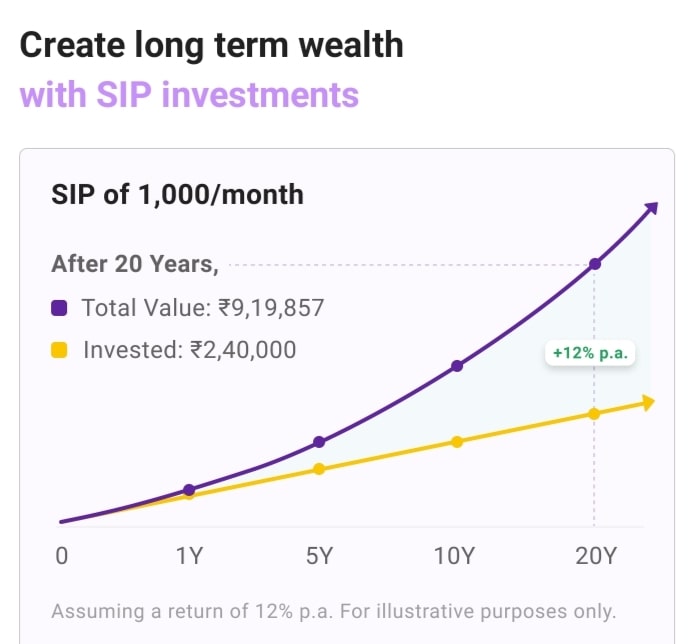

Then he thought that I should make some investment for the future, so, then he started a SIP investment of Rs.10,000 from his salary, and he would invest in SIP for 20 years.

So his total investment becomes 24 lakhs for 20 years, which he will make the total investment.

And here we will assume that his investment is increasing on an average of 7% on yearly basis. If his annual investment is seen at 7%, then his investment is growing.

When Suresh turns 55 years old, his investment net worth will be around Rs 52.4 Lakhs, the total value of what he has invested.

Let us take the name of another man who joined the job with Suresh

Example ②

Whose name was Ramesh, who joined the job at the age of 25, which was 10 years earlier than Suresh

And he did the same thing, Started investing in SIP At the age of 25 years old in 10,000 monthly.

For the next 30 years, he kept on filling his SIP investments, making his total investment 36 lakhs and his value investments growing at 7% per annual, but when Ramesh turned 55, his investment net worth became 1.22 Crore rupees.

It is seen here that Ramesh’s net worth by starting SIP 10 years ago becomes more than double in Suresh’s comparison.

Power of Compounding by Albert Einstein

Albert Einstein famously Said

“Compound Interest is the 8th wonder of the world. He who understands it, earns it; he who doesn’t, pays it.”

Rule of Power of Compounding

The sooner you start your investment the more time money has to grow

That Means, With SIP investment, we get the means by which we can start investing as soon as possible and also start investing in SIP with just Rs 500.

I do not have money to invest, it is an excuse, it can be reduced further.

Features of SIP

① SIP done Only in Open-ended funds

SIP Investment You can withdraw your money whenever you want and And here there is no tenure fixed

② No fixed tenure

i.e. there is no commitment that you have to deposit money for so many years.

③ Select a SIP tenure can be Overridden

Suppose you have ever fixed the tenure that I will deposit money for so many years, then when you feel that I do not want to invest then you can stop SIP investment.

If you are in SIP investment tenure of 5 years but when your SIP investment tenure is over then you can also increase your tenure by speaking to your mutual fund’s company

④ Perpetual SIP

Where there is no last ensure that you have to deposit for so many years, you can invest as long as you want

⑤ Full and partial withdrawal

You can withdraw your full investment amount whenever you want before the end of the tenure or after the end of the tenure.

⑥ SIP amount can be increased or decreased

Whenever you want, you can reduce or increase your SIP investment, for example, if you are investing 10,000 monthly, then you can also make that SIP investment of 5000 in the coming time or 15,000 can also do that,

So because of all this flexibility, SIP investment becomes an ideal investment for those investors who are dependent on regular, monthly income.

Why to Invest in SIP

① Helps to manage market volatility

- It will help you manage market volatility

② Discipline your financial decision

- To follow up on your financial decisions

③ No charges to invest in SIP

And there will be no charge for investing in

④ Compounding Interest benefit

- You will get the benefit of compound interest

⑤ Start with as low as Rs 500

- And the investment amount is not much in this, you can start a SIP investment event in 500 rupees

Benefits of SIP

5 Benefits of SIP | Advantages of Investing in SIP

① Start with small Investment for beginners

This is a small investment so that you do not have any luck that I am investing so much money, you can start investing in it with 500 rupees and this is also a benefits of SIP

“a small investment makes a big difference”

② Low Investment Risk

There is a lot of low investment in the fabric of the share market in SIP and By investing in SIP, your risk level becomes very less than that of Stock SIP

Because of all these things, it is a benefits of sip to invest in flame.

③ Disciplinary Investments

Another benefits of sip is that it is a disciplinary investment, ie we all feel that if our salary will increase, then we will invest here, invest there and try to get a good return.

But this does not happen in SIP at all. Because you will invest by looking at your salary savings.

And that’s how you make your savings into a disciplinary investment.

④ Automatic Timing

If suppose, you want to invest in the share market, then you have to invest in the stock by looking at the proper timing. But SIP is not like that at all.

Benefits of SIP keeps on investing in every stage, due to which there is no need to worry about market timing, and even without having knowledge of the share market, you can easily get a big return by investing a little bit of savings.

⑤ Reduce Average Purchase Price of Mutual Fund Units

And one of the benefits of sip is that SIP reduces the average purchase price of the mutual fund.

Important Notes : Achieve Long Term Investment GoalsWith its benefits of sip, you can achieve your long-term goal.

Example, That is, for any long-term goal like building a house, or studying, getting married, or having a comfortable and enjoyable life after Retirement. With the help of all these long-term goals, you can easily achieve your goal with the help of benefits of sip

Because of all these things, we have one of the benefits of SIP investing in SIP.

How to Start SIP

You can start SIP with the help of your fund house. Or you can also start offline by going to the office of your fund house.

How to Start SIP Online

You can start it online by going to your fund house account with the help of the Mobile Application. But whether you start online or offline, in both these cases, you will have to complete your KYC first. You can complete KYC online, offline, or with the help of any KYC agency.

For KYC, you have to provide your documents, proof of identity, proof of address, your photo, and PAN card, you can do KYC by giving all these.

After KYC, you have to select any scheme of your fund house, after selecting the scheme you have to select some more details like amount, how much amount you want to start, the frequency for how long you want to deposit Generally, people deposit in 1 month and period of duration, For how long do you want to invest,

after submitting all these processes, your SIP will start. And your bank account will start getting detected automatically and your mutual fund portfolio will start getting deposited and

In this way, your investment will increase and you will not get any extra charge or any penalty if you ever want to stop your SIP.

Now you must be thinking that what is this fund house and KYC?

What is Fund House

Fund house means, where is the account of mutual fund and in which company you have started or want how to start SIP

What is KYC

KYC ( Know Your Customer ) From KYC, we find out what is their identity, means their identity, whether we do aadhar card, voter id, or pan card, through all these others,

We KYC someone and verify them that their link is somewhere else. It is not related to things, this is the whole process we call KYC.

Difference between SIP and Mutual fund

SIP and Mutual Fund are not separate, but they are both related to each other and let us know the difference between Sip and Mutual fund, how these two work with each other sip vs mutual fund.

① What is the difference between sip and mutual fund difference

Mutual Fund

In mutual fund, Group of people deposit money together in one fund.

SIP

And in mutual funds, they invest money in two ways, Lumpsum and SIP.

A mutual fund is a fund where we put money and the way we put that money, that process we call it SIP

That means, SIP up is a way to invest money in mutual funds

You must have understood by now the difference between mutual fund and sip.

Lump sum vs sip

Lumpsum

Lumpsum has given money only once, after that you are not investing anything in a mutual fund

that means,The process of Investing one time in mutual fund is called lumpsum.

SIP

In this, you can put money in mutual funds every month, or you can donate every week

that means,The process of investing in the fund again and again is called SIP.

Lump sum vs sip, you must have understood how both of these work for investing in mutual funds.

Is SIP Safe

SIP is a very good way to deposit in mutual funds and it is also very safe. And if you deposit in any mutual fund outside the market, then its compare SIP is absolutely is sip safe. When there is not much value in the market then Is sip safe here to invest.

Is SIP Safe for Future Investment

Yes Is SIP safe to invest for the future, Because here you will get a good return without any loss or fear

Is sip tax free

We will define in two ways whether the tax will be levied or not,

- Long-Term Capital Gain (LTCG)

- Short-Term Capital Gain (STCG)

① Long-Term Capital Gain

If the long-term capital gain is taxable only if it is more than 1 lakh and there is a rate of 10% then only & No tax will be levied if it is less than 1 lakh.

taxable at the rate of 10% without the benefit of indexation

Tax Rate: 10%

Period of Holding: (More than one year)

Less: Cost of acquisition (B): 1,50,000

② Short-Term Capital Gain

In the short term, the tax will be charged at the rate of 15%

taxable at the rate of 15%

Tax Rate: 15%

Tax on short-term capital gains is applicable to short term capital gains, irrespective of your tax slab.

FAQ [frequiently Asked Question]

How sip works

1. Chose flexible pre-determined amount and interval

2. Auto-debited from your bank account

3. Investment in a specific mutual fund scheme

4. Allocated a certain number of units

5. Benefits certain-Cost Averaging and Power of Compounding 6. Benefits of Rupee-Cost Averaging and Power of Compounding

Benefits of sip

① Start with small Investment for beginners

② Low Investment Risk

③ Disciplinary Investments

④ Automatic Timing

⑤ Reduce Average Purchase Price of Mutual Fund Units

Difference between sip and mutual fund

SIP and Mutual Fund are not separate, but they are both related to each other and let us know the difference between Sip and Mutual fund, how these two work with each other sip vs mutual fund.

How to start sip online

You can start it online by going to your fund house account with the help of the Mobile Application. But whether you start online or offline, in both these cases, you will have to complete your KYC first. You can complete KYC online, offline, or with the help of any KYC agency.

For KYC, you have to provide your documents, proof of identity, proof of address, your photo, and PAN card, you can do KYC by giving all these.

Lump sum vs sip

Lump-Sum :

Lumpsum has given money only once, after that you are not investing anything in a mutual fund

SIP :

In this, you can put money in mutual funds every month, or you can donate every week

Is SIP Safe

SIP is a very good way to deposit in mutual funds and it is also very safe. And if you deposit in any mutual fund outside the market, then its compare SIP is absolutely is sip safe. When there is not much value in the market then Is sip safe here to invest.

Is sip tax free

① Long-Term Capital Gain

If the long-term capital gain is taxable only if it is more than 1 lakh and there is a rate of 10% then only & No tax will be levied if it is less than 1 lakh.

taxable at the rate of 10% without the benefit of indexation

Tax Rate: 10%

Period of Holding: (More than one year)

Less: Cost of acquisition (B): 1,50,000

② Short-Term Capital Gain

In the short term, the tax will be charged at the rate of 15%

taxable at the rate of 15%

Tax Rate: 15%

Tax on short-term capital gains is applicable to short-term capital gains, irrespective of your tax slab.

Related Terms

- Explain the Nature and Scope of Financial Management

- The Most Important Features of Management | 7 Characteristics of Management

- Most Importance of management Control | Management activities

- 10 Easy Steps to Start Your E Commerce Framework Business

- Future Scope of ecommerce | functions of e commerce

- Scope of ebusiness | Features of e business

- Most Important Features of eCommerce

- [Best] 10 Ways Improves the flow of business ideas With Low Investment

Summary & Conclusion

Maybe you will no longer have a problem with how sip works, How to start sip, benefits of sip, the difference between sip and mutual fund difference, how to start sip online, features of SIP, sip vs mutual fund and more

So, After reading all this, you must have known

Like this information Or have something to share!

Connect with us on Facebook